At the pre-seed stage, founders often fall into a painful GTM trap.

Share too little, and investors worry you’re avoiding the hardest part of building a company. Share too much, and you sound disconnected from reality, forecasting aggressive revenue or enterprise deals before meaningful validation exists.

This tension is one of the fastest ways to lose credibility with experienced investors.

The truth is straightforward: at pre-seed, investors are not betting on spreadsheet accuracy. They’re betting on your ability to think strategically, validate assumptions, and learn faster than the market.

That’s where the Pre-Seed GTM Goldilocks Zone comes in, a level of go-to-market thinking that is just right.

In this article, we break down the four GTM components investors actually expect at pre-seed, how to communicate them effectively, and how founders can use early execution, especially through thoughtful product development, to support their GTM narrative.

Why GTM Expectations Are Different at Pre-Seed

At later stages, GTM is about optimization and scale: expanding channels, improving conversion rates, and forecasting with confidence.

Pre-seed is fundamentally different.

At this stage:

- The product is early or evolving

- Customer understanding is incomplete

- Distribution channels are unproven

- Revenue is mostly hypothetical

Investors understand this reality.

What they don’t want is either extreme:

- Too vague: “We’ll figure GTM out after the raise.”

- Too optimistic: “We’ll close large customers in our first 30 days.”

Instead, they look for disciplined thinking and credible learning signals.

Step 1: Problem–Solution Validation

Before channels or revenue models, investors want to know one thing:

Does this problem genuinely exist, and do real customers care enough to try a solution?

At pre-seed, validation does not require massive traction. It requires evidence of intent:

- Insightful customer interviews

- Early pilots, waitlists, or letters of intent

- Usage data from a prototype or MVP

- A clear understanding of how the problem is solved today

Founders who invest early in building a functional MVP, often through custom software development, are better positioned to generate these signals. Even a narrow, well-scoped product can unlock real conversations, real feedback, and real learning.

What matters is not the volume of data, but the depth of insight behind it.

Investor red flag: Validation based purely on assumptions, market reports, or founder intuition.

Step 2: A Thoughtful Target Customer Definition

“Everyone” is not a customer.

At pre-seed, focus is a strength, not a limitation. Investors want to see that you’ve intentionally chosen a starting point that maximizes learning.

A strong target customer definition answers:

- Who experiences the problem most acutely?

- Who is the buyer versus the end user?

- Who influences the purchasing decision?

- Why is this customer motivated to change now?

Great founders are explicit about tradeoffs:

“We’re starting with this segment because it lets us learn fastest, not because it’s the final market.”

That level of clarity signals strategic maturity.

Investor red flag: Broad personas that ignore real buying behavior or decision-making dynamics.

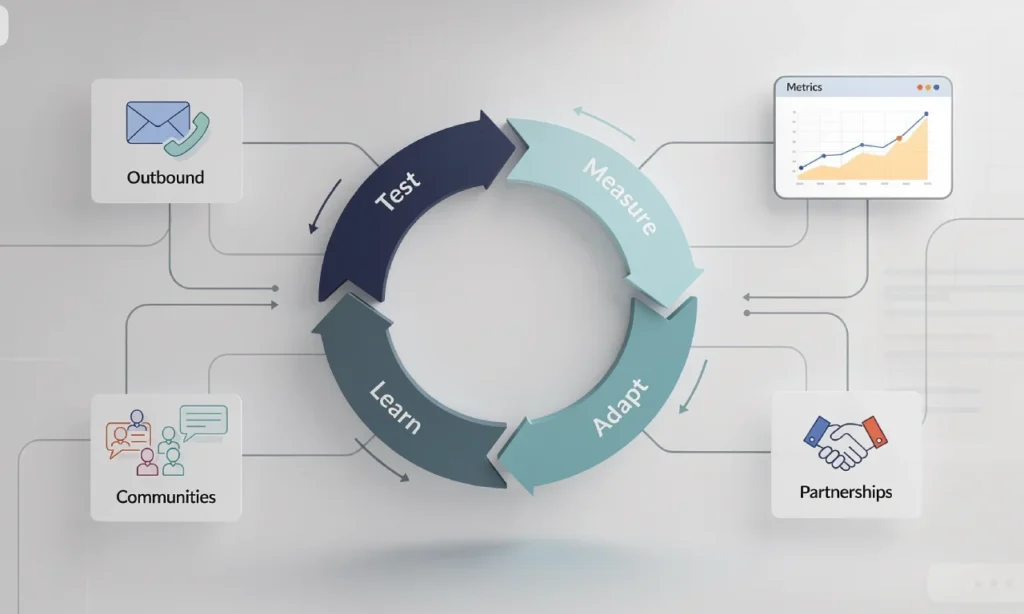

Step 3: A Focused Channel Strategy

Pre-seed GTM is about experimentation, not scale.

Investors typically expect:

- Two to three initial acquisition channels

- A clear hypothesis for why each channel might work

- Defined learning goals, even if results are early or mixed

Examples of credible pre-seed channels include:

- Founder-led outbound or inbound sales

- Niche communities and networks

- Early partnerships

- Thought leadership aimed at a narrow audience

What matters most is your learning loop:

“Here’s what we’re testing, how we’ll measure it, and what we’ll change based on the outcome.”

Investor red flag: Long lists of channels with no prioritization or feedback mechanism.

Step 4: A Realistic Revenue Timeline

Revenue projections are where many pre-seed pitches lose credibility.

Investors don’t expect precision, but they do expect realism.

A strong pre-seed revenue narrative emphasizes:

- Milestones instead of aggressive monthly targets

- Key assumptions and dependencies

- Risks that could delay revenue

For example:

- Validate willingness to pay

- Convert pilots into initial contracts

- Shorten feedback loops before scaling sales

This approach shows maturity and respect for execution reality.

Investor red flag: Hockey-stick projections with no explanation of how deals actually close.

The Common Thread: Strategic Learning

Across all four steps, investors are asking the same core question:

Can this team learn faster than the market evolves?

The Pre-Seed GTM Goldilocks Zone is not about having perfect answers. It’s about demonstrating:

- Clear thinking

- Honest assumptions

- Fast, disciplined experimentation

Founders who strike this balance don’t just raise capital more effectively, they build companies with stronger foundations.

Conclusion

If you’re preparing a pre-seed pitch, the goal is not to appear flawless. It’s to appear credible.

Avoid being vague to hide uncertainty. Avoid being overly optimistic to impress.

Instead, focus on clarity, learning, and execution, supported by early validation and thoughtful product development.

That’s the real GTM Goldilocks Zone. And it’s exactly where pre-seed investors want you to be.